FAQs

Frequently Asked Questions:

2024 Power to Heal Campaign

What is the Power to Heal Campaign?

The Power to Heal campaign is the annual opportunity for MedStar Health associates to make a philanthropic gift and share a message of gratitude with a colleague.

When can I participate?

ANYTIME! Your philanthropic gift and gratitude messages are welcome today, or anytime during the year.

Who will benefit from my contribution?

Funds will again support wellbeing initiatives at entities throughout MedStar Health, benefiting our associates.

Where can I participate?

- Click here to make a philanthropic gift and send a gratitude message online.

- Text GRATITUDE to 51555

- Complete the commitment form and email to powertoheal@medstar.net.

How does the Power to Heal campaign work?

It’s simple! You can share kind words with a colleague via the online form. If you wish to make a commitment, you can through:

- Recurring monthly credit card gift

- One-time gift: cash, credit card, check

- Charitable estate gift

- Auto renewal payroll deduction

*The amount of your choice will be deducted from your biweekly paycheck beginning the first Jan. 2025 pay date and will continue indefinitely until you contact the MedStar Health philanthropy team at powertoheal@medstar.net.

When will my payroll deduction start?

January 3, 2025

Please note, this year, you must complete a new payroll deduction form to continue to participate. Click here to participate today.

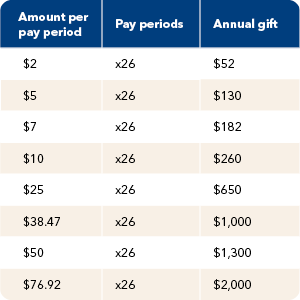

What is my annual payroll deduction contribution?

If you are interested in payroll deduction, the chart below outlines suggested investment amounts.

If I missed signing up for payroll deduction in 2023; can I start a recurring gift any time of the year?

Yes! Please click here to participate at any time. If you have questions about the process, please email powertoheal@medstar.net.

How do I update my payroll deduction?

To update, change, or stop your current payroll deduction before January, please email powertoheal@medstar.net.

Can I make a one-time deduction via payroll?

Yes, you can make a one-time payroll deduction on the first pay date, Jan. 3, 2025, for a minimum donation amount of $10.

Where can I find my receipt for tax purposes?

Your total deduction for the year can be found on your pay stub. To view your deduction, click here and navigate to “Self Service,” then click on "Payroll and Tax." Here you will see your past paychecks. Click on your paycheck and you will see a field towards the bottom named "After-Tax Deductions: MedStar Health Gift."

For more information about your pay stub, click here.

Can I support more than one fund?

Yes! Simply indicate how much you would like to designate to each fund on the form.

For any additional questions, please contact the philanthropy office at powertoheal@medstar.net or call 410-772-6747.